Many Americans are feeling the strain of rising costs and limited savings in 2025. Living paycheck to paycheck is common, and financial setbacks are taking a real toll on people's everyday lives. But there are also ways to stretch your dollars further and start building a stronger financial foundation. Based on a nationwide survey of over 1,000 adults, we'll explore how people are managing without a savings safety net and offer practical tips to help you save smarter and feel more in control.

Key Takeaways

- Over 2 in 5 Americans (42%) have run out of money before their next paycheck in the last 12 months.

- 55% of Gen Z believe the American Dream is no longer achievable.

- On average, Americans say they would need about $100,000 in savings to feel financially secure.

- Nearly 1 in 4 Americans (24%) say they would need over $500,000 in savings to feel financially secure.

- 1 in 4 Americans do not have any money saved for emergencies.

How Often Americans Run Out of Money

Unexpected expenses or a few extra days between paychecks can quickly throw a budget off track. Many people are finding that even careful planning isn't always enough.

In the past year, 42% of Americans said they ran out of money before their next paycheck. For parents with school-aged children, that number climbed to 47%. Gen Z reported the highest rate of paycheck shortfalls at 46%, followed closely by millennials (43%) and Gen X (42%). Baby boomers were less likely to experience this (26%).

Running out of money before your next paycheck can be stressful, but there are ways to save on a tight budget. Start by focusing on essentials like housing, food, utilities, and transportation. Try trimming non-essential spending for now (such as subscriptions or dining out) and explore community resources or paycheck advance options. If bills are due, reach out to providers about extensions or hardship programs, and when things stabilize, set aside even a small buffer each paycheck to ease the pressure next time.

The State of Emergency Savings in 2025

Some Americans are still working toward building emergency savings. Knowing what causes people to run out of money before payday can help identify smart ways to plan ahead and stay prepared.

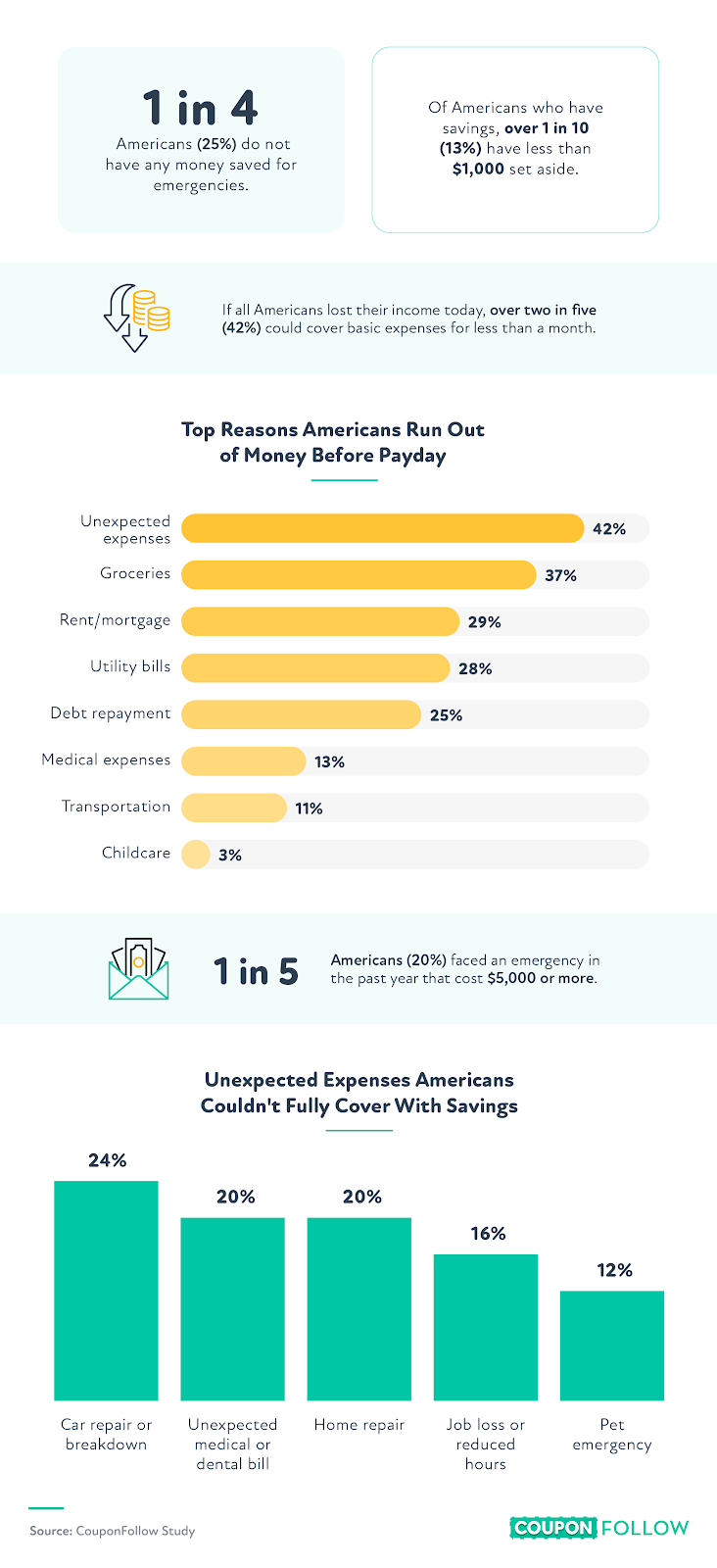

Americans most often ran out of money before payday due to unexpected expenses (42%). Most often, these costs came from a car repar (24%), medical or dental bill (20%), or home repair (20%). If they missed a paycheck, Americans were most likely not to pay for credit card bills (16%), medical bills (12%), and groceries (10%).

To make ends meet in the past year, Americans most often took on a side hustle or gig work (44%). Others used credit cards (41%), sold personal items (25%), relied on Buy Now, Pay Later (BNPL) services (21%), or borrowed from friends or family (20%). Gen Z stood out for BNPL use, with 23% having used these services in the past year, though 17% of all BNPL users regretted doing so.

Most Americans (75%) said they have money set aside for unexpected costs. However, 13% had less than $1,000 in emergency savings, and 25% had none. The likelihood of having no savings was higher among Gen X (27%), millennials (26%), and Gen Z (26%) than among baby boomers (17%).

On average, Americans have about $7,200 in emergency funds, enough to cover basic expenses for roughly 2.5 months if they lost all income. The average person's most costly emergency in the past year was $1,800.

Even a small emergency fund can go a long way toward reducing stress when unexpected expenses happen. Saving just a little from each paycheck (even $20–$50) can help build a safety net over time. Having even a modest cushion means being better prepared to handle surprise costs.

The Emotional Toll of Living Without Savings

Money worries can affect more than just your bank account. For many people, financial stress is showing up in their health, relationships, and overall sense of security.

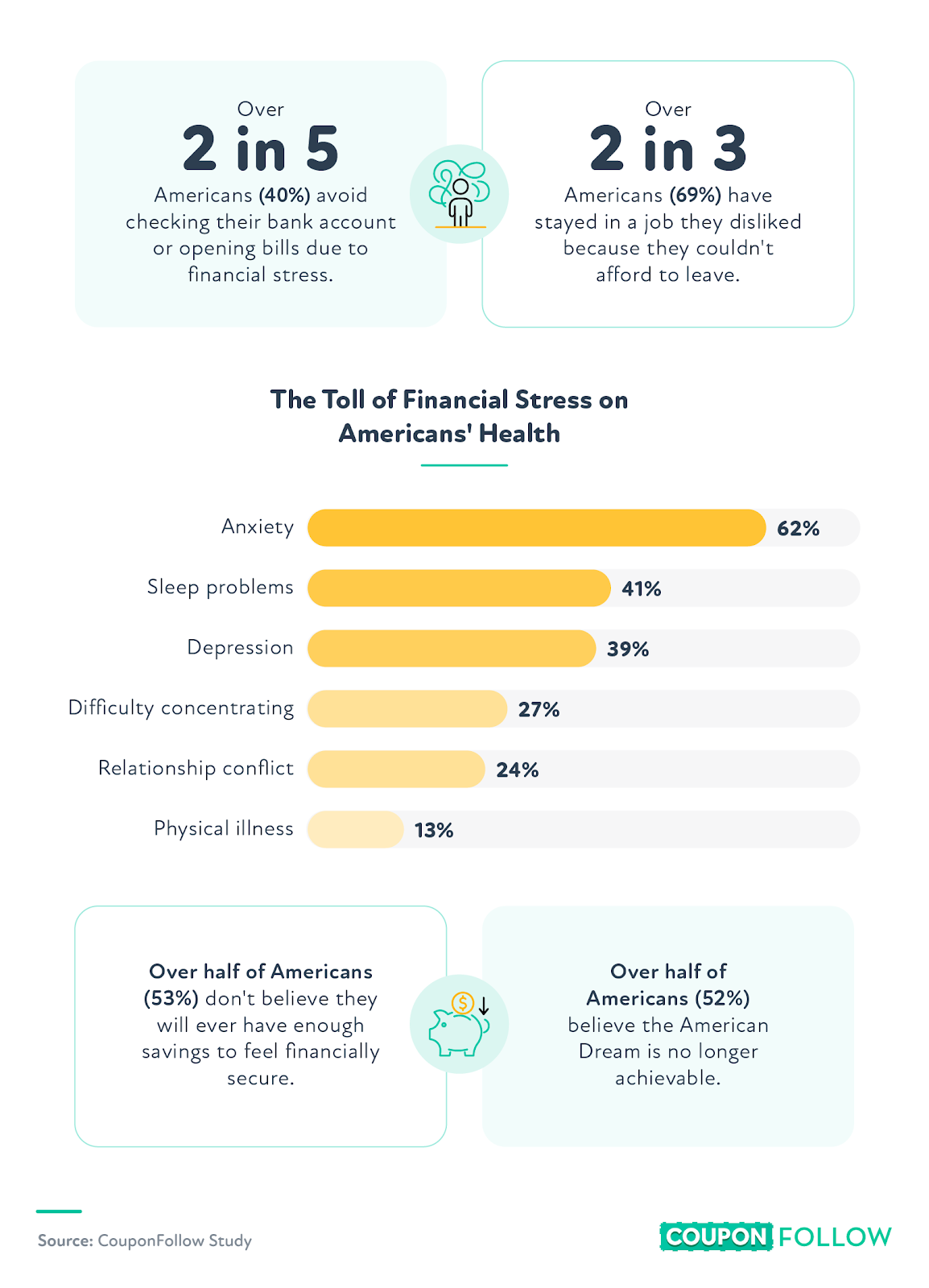

Financial stress is affecting Americans across generations. Half of Gen Z, 42% of millennials, 40% of Gen X, and 16% of baby boomers said they avoid checking their bank account or opening bills due to money worries. Many also stayed in jobs they dislike because they couldn't afford to leave, including 75% of Gen X, 69% of millennials, 68% of Gen Z, and 53% of baby boomers.

When faced with a financial emergency, many said they would first sell personal belongings (49%), max out a credit card (36%), skip meals (35%), or delay paying bills (34%). The most common reasons people would hesitate to ask for help included not wanting to burden others (67%), embarrassment (51%), and pride or independence (43%).

Belief in the American Dream is slipping: 57% of millennials, 55% of Gen Z, 45% of Gen X, and 42% of baby boomers said it's no longer achievable. Additionally, 59% of baby boomers, 56% of Gen X, 52% of millennials, and 45% of Gen Z believe they will never have enough savings to feel financially secure. On average, Americans said they'd need $100,000 in savings to feel secure, but nearly 1 in 4 (24%) would require more than $500,000.

Why Savings Matter and How to Build a Safety Net

In 2025, millions of Americans are navigating financial uncertainty, but even small steps can make a difference. Building an emergency fund doesn't have to happen overnight. With a few consistent habits, it's possible to create a stronger financial foundation over time. Here are a few simple ways to start:

- Set a weekly or monthly savings goal, even if it's just $5 or $10.

- Automate transfers to your savings account so you don't have to think about it.

- Cut back on one non-essential expense each month and put that money toward savings.

- Take advantage of side hustles or freelance gigs to bring in extra income.

- Use savings tools to find discounts, promo codes, and deals.

Having savings helps you feel more prepared for emergencies, but it also provides peace of mind, freedom to make career choices, and flexibility to enjoy life's opportunities. At CouponFollow, we're here to help shoppers make the most of every dollar. Whether you're shopping for essentials or treating yourself, our tools help you save money that can go toward your bigger financial goals. Smart spending paired with small, steady savings can turn uncertainty into confidence.

Methodology

In August 2025, we surveyed 1,006 Americans to explore the financial fragility of Americans living paycheck to paycheck. The average age was 41; 50% were female, and 50% were male. Generationally, 10% were baby boomers, 24% were Gen X, 47% were millennials, and 20% were Gen Z.

About CouponFollow

CouponFollow makes it easier for shoppers to save money online. From up-to-date promo codes to helpful insights on spending trends, it's a go-to resource for anyone looking to shop smarter and stretch their budget further.

Fair Use Statement

The information in this article may be used for noncommercial purposes only. If shared, please include a link to the original content on CouponFollow with proper attribution.